Join Invacare at Superhero Series powered by Marvel this summer

We’re looking for ‘superheroes’ to join us this summer for a 'super' fun day of sports activities at the Superhero Tri powered by Marvel on 17 August at Dorney Lake, Windsor. This event is …

EXCITING ANNOUNCEMENT – CLARE BALDING CBE TO HOST NATIONAL DIVERSITY AWARDS 2024

We are thrilled to announce award-winning broadcaster and author Clare Balding as o…

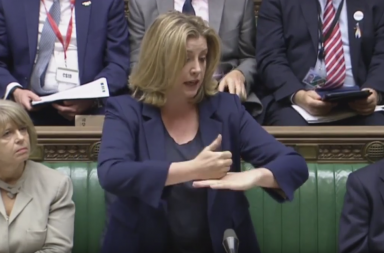

Interview – Vicky Foxcroft MP “It’s about working with disabled people to get our policies right.”

With a general election likely this year, Shadow Minister for Disabled People Vicky…

Pillow Talk – Getting a good night’s sleep

Sleep is an important aspect of physical and mental wellbeing, yet so many of us st…

Cosyfeet, extra wide Juno shoes

Petite and sporty, Juno shoes will be a big hit this summer. Juno shoes have a s…

Able Magazine Enjoys Another Successful Naidex!

Able Magazine was again proud to have been selected as Headline Media Partner with …

The Brotherwood WAV & Mobility Show returns with a new format this May

The Brotherwood WAV Show returns to Haynes Motor Museum in Sparkford, Somerset from…

Germany’s Top Accessible Highlights

Berlin Museum Island © Getty Images/Tomas Sereda Discover Germany’s many cha…

The Motability Scheme’s Big Event is back with an electrifying line-up for 2024

The Big Event programme is returning for 2024, with a new focus on electric motorin…

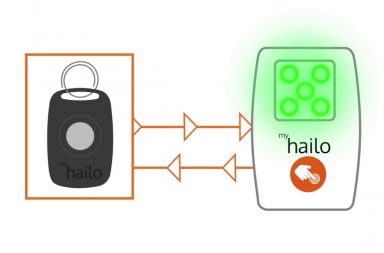

I started with a simple goal of wanting to create a better, more reliable powered wheelchair.

I’ve been a powerchair user for over 20 years. I got my first chair at school and b…

Nominations are now Open for the National Diversity Awards in association with HSBC UK!

The National Diversity Awards will be held on 4th October at the Liverpool Anglican…

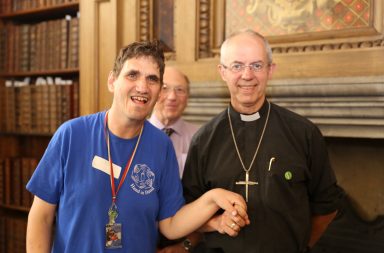

BBC Ability

BBC Ability is one of the staff-led networks at the BBC, run by disabled people,for…

BBL Batteries at Naidex

Ready to Power your world! We are delighted to announce that we will be launchi…

Closing the Disability Employment Gap

82% of disabled candidates surveyed, said the biggest barrier to work was not being…

How to die?

Just because a celebrity (in this case, the much loved and respected, Dame Esther R…

Interview – Marion Fellows MP – “Vote for a party that will support you”

With the general election fast approaching and amid the campaign buzz, it’s importa…

Dreaming Ahead with Julie Childs

Julie Childs, from Faringdon has a penchant for crafts and creating beautiful thing…

Nominations Open in 1 Week for The National Diversity Awards!

The 2024 National Diversity Awards will be held once again at the breathtaking Live…

Aerobility’s beloved ‘Armchair Airshow’ to return with live audience as ‘Aerobility Live’

‘Aerobility Live’ will bring the skills and thrills of aviation into your own home,…

‘THE FIRST OF ITS KIND’: NEW INCLUSIVE PLAYGROUND SETS THE STANDARD FOR ACCESSIBILITY IN THE UK

Heralded as ‘the first of its kind’, a new inclusive and accessible playground - wh…

Mental Health Advocate Roman Kemp Announced as Keynote Speaker at Naidex 2024

Naidex, the UK's premier event for the disability community, proudly announces …

Interview – Jenny Sealey

Jenny Sealey has been the artistic director of the Graeae Theatre Company since 199…

SUPERDRUG PLEDGE TO ENROL 500 NEW APPRENTICES IN 2024 AND CONTINUE TO SUPPORT YOUNG PEOPLE WITH THEIR LIFE SKILLS PROGRAMME

Superdrug have pledged to take on a further 500 apprentices throughout 2024 alongsi…

Disabled pilots fly Avion’s revolutionary A320 Flight Simulator

Disabled flyers from charity ‘Aerobility’ had a unique day of flying in the Avion A…

LEADING DISABILITY EQUIPMENT MANUFACTURER INVACARE JOINS SUPERHERO SERIES FOR 2024

Invacare®, one of the World’s leading disability product and equipment manufacturer…

Snowdon powered wheelchair race raises £27,000 within first week of campaign launch

26 January 2024 - A charity race up Snowdon planned by two friends in powered wheel…

Nominations for The National Diversity Awards open 15th March 2024!

The 2024 National Diversity Awards will be held once again at the breathtaking Live…